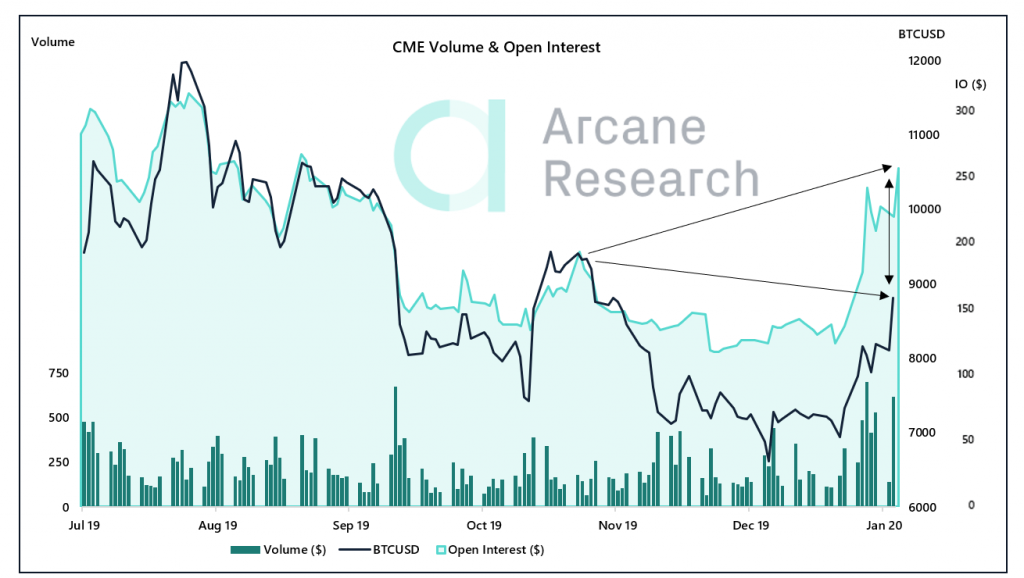

By comparing the bitcoin exchange rate, with the trading volume, as well as the number of open positions on the CME. We see signs that the market is now behaving differently than the last time bitcoin rose.

Read the full report to Arcane Research here.

Growth in open positions

At the end of October last year, the bitcoin exchange rate jumped 42% in one day. After Chinese President Xi announced his commitment to blockchain the country. When it was understood that this had little to do with bitcoin, the exchange rate quickly reversed. The upturn we are seeing now in 2020 follows a completely different trend, with relatively stable growth over several weeks.

The figures from CME shows, that there is also another trading pattern among institutional investors this time. Open positions now amount to approximately $ 240 million. This is almost $100 million more than last time bitcoin was at the same price we see these days.

Increased trading volume

There is also a clear shift in CME’s trading volume in 2020. Over the past period, the daily volume has been upwards of $500- $700 million several times. This is significantly higher than the volume seen in October.

New times ahead?

This activity among investors was not seen last time the bitcoin price jumped upwards in October 2019. This may indicate that we are now seeing a fundamental change in the appetite for bitcoin and that the sentiment in the market is really on the verge of turning.