Kryptographen highlights the top 10 moments from the past year.

The lightning torch

This list would not be possible without talking about the experiment done by the lightning hero from Norway, @hodlonaut. In January, he announced a project that would send 100,000 satoshis through the Lightning network, the recipient would then again send along with 10,000 new satoshis. The goal was to raise awareness of this new exciting technology. This “chain letter” went around the world in the same way as the Olympic fire and was attended by a number of well-known people and actors. On the list of those who were eventually called the “torchbearers”, we find, among others, Twitter CEO Jack Dorsey, financial giant Fidelity, co-founder of LinkedIn Reid Hoffmann and an 88-year-old grandmother.

Jack Dorsey

This takes us to the founder of Twitter and the company Square, Jack Dorsey. He has been central throughout the year and talked hotly about bitcoin and the huge potential. He has gone out in the media by blocking political advertising on Twitter and saying that Twitter should never be part of Facebook’s Libra. At the same time, he pointed to Bitcoin as the money of the future. Square is the company behind America’s most popular financial app, CashApp. Here, buying, selling and storing bitcoin is possible, and according to Jack, it’s only a matter of time before lightning technology gets to the popular app. As if that wasn’t enough, he has also started the company Square Crypto, which aims to contribute to the development of the bitcoin protocol and associated systems. In other words, Jack is a true champion of Bitcoin.

Libra

Naturally, Libra has also been included on the list. There was a huge uproar this summer when Facebook went out and surprised the world with its new venture, a global cryptocurrency (stablecoin). From a “help the unbanked” point of view, this has expanded into a political battle where cryptocurrency, and not least bitcoin, has ended up on the US Senate agenda, where Mark Zuckerberg has had to answer. Who knows where this will end? Either way, there is no doubt that an extremely many high-ranking and important people have been introduced to the phenomenon of cryptocurrency and stablecoins. In addition, the uprising around Libra has made clear the benefit of decentralization. While Mark has to deal with contradictory and impossible demands of American politicians who can prevent the launch, Satoshi can sit back and watch bitcoin grow bigger and stronger day by day.

China

Once we get into politics, we can move on to China. The superpower that was supposed to open for blockchain and cryptocurrency. Whether this was the reason for the massive jump (42%) in the bit competition earlier this fall is hard to say, but there was a hint of euphoria after the statement by President Xi and many thought the road to new “all-time high” was short. The illusion disappeared almost as quickly as it emerged, and it gradually emerged that China should focus on blockchain technology and Chinese stablecoin, and not a cryptocurrency. The state which has full control over its inhabitants will obviously not relinquish this.

DeFi

Furthermore, 2019 has seen tremendous growth in what is called decentralized finance (DeFi). Services that both allow you to take out loans with cryptocurrency as collateral without slow and expensive intermediaries pop up like mushrooms. This will also be exciting to follow in the new year, where we may be able to glimpse the meager beginnings of individual beliefs that could be the major migration for the global credit market into the fully digital and decentralized world.

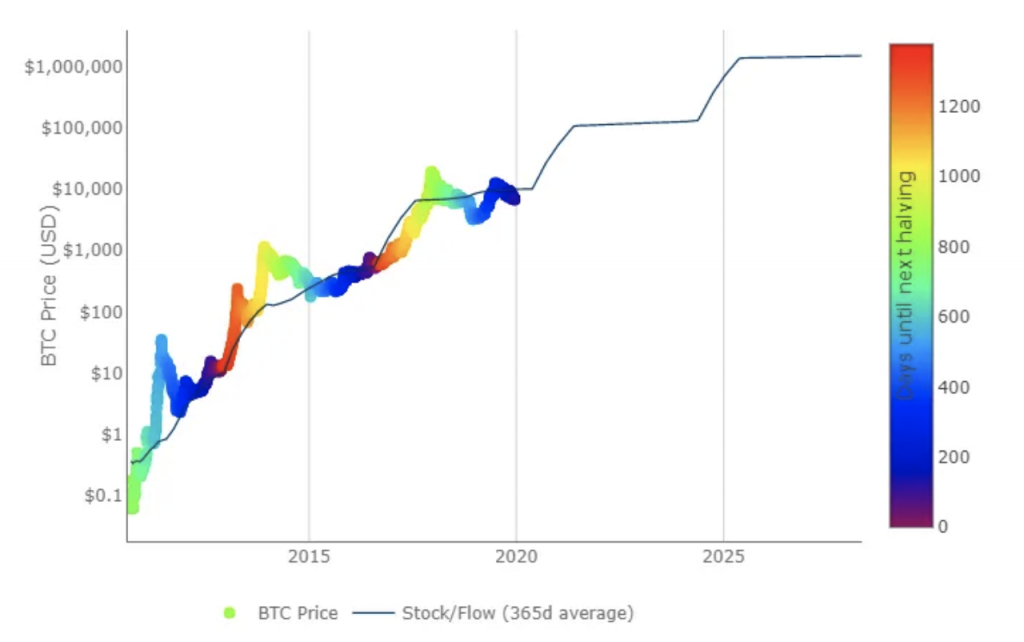

Stock-to-flow

Something else that will also be exciting to follow in 2020 is the so-called “Stock-to-flow” model that has become popular this year. With its high historical explanatory power, stable parameters and co-integration, a cult of bitcoin optimists have gradually emerged around the twitter user @100trillionUSD, who made the first estimates. The model analyzes the value of bitcoin as a function of scarcity and thus the halves that occur every four years. The next half for bitcoin is estimated to arrive in May 2020, and the model now estimates a bitcoin rate of around $ 100,000. Will history repeat itself?

Bakkt

What many hoped would drive the bitcoin course was the launch of Intercontinental Exchange, the owner of NYSE (the world’s largest exchange), its new crypto venture. Bakkt opened earlier this fall and offers professional clients trading in futures contracts for bitcoin, as well as the storage of bitcoin. These futures contracts have physical settlements at the end of each month and the hope of increased demand for bitcoin was high. However, since its launch, the bitcoin exchange rate has plummeted and Bakkt’s trading volume has been minimal, albeit with strong growth. In any case, this has opened the door to bitcoin for a huge number of professional investors and institutions, which previously did not have access, and is nevertheless an important step towards a more mature market.

Big companies and institutions

The focus has also been on a number of large companies and institutions around the world. Behind Bakkt is, as I said, the owner of the world’s largest stock exchange, as well as Microsoft, Starbucks and Boston Consulting Group. Microsoft also works on cryptocurrency on its own and develops a decentralized identity. Fidelity, as one of the world’s largest asset managers, has launched a dedicated solution for its customers, for trading and storage of cryptocurrencies. Other major players that should be mentioned are Boerse Stuttgart which has opened a cryptocurrency exchange and SIX, the leading exchange in Switzerland, which has launched the prototype of its new cryptocurrency exchange.

Norwegian companies

Much time has also been spent on covering development in Norway. Here, companies of all kinds are emerging. The Norwegian Block Exchange is perhaps the largest player, which will create its own crypto exchange and eventually work with the airline Norwegian. In addition, we have Axie Infinity with the Norwegian founder, who is a leader in decentralized gaming. Furthermore, we have Blockchangers who have contributed to the DeFi field with their rebalance.to, and other companies like Dune Analytics with their analysis tools for Ethereum, WiV, Norway-in-a-box, and the scaling protocol Nahmii.

Bitcoin

Last but not least, Bitcoin. The blockchain and its currency have been central throughout 2019. This will be called by many for a bitcoin-focused year, both in terms of price trends, but also with the underlying developments we have seen in the industry. It is becoming clearer and clearer that bitcoin will have a leading role in the crypto world, both as a value object and technology. Bitcoin rose from a heavy winter in early 2019 and has shown during the year that this is a system that will not stop immediately. However, the King will not stand alone and there is an ever-growing pile of altcoins of all shapes and colors that complement, innovate and compete.