Miners are making more on Ethereum than Bitcoin

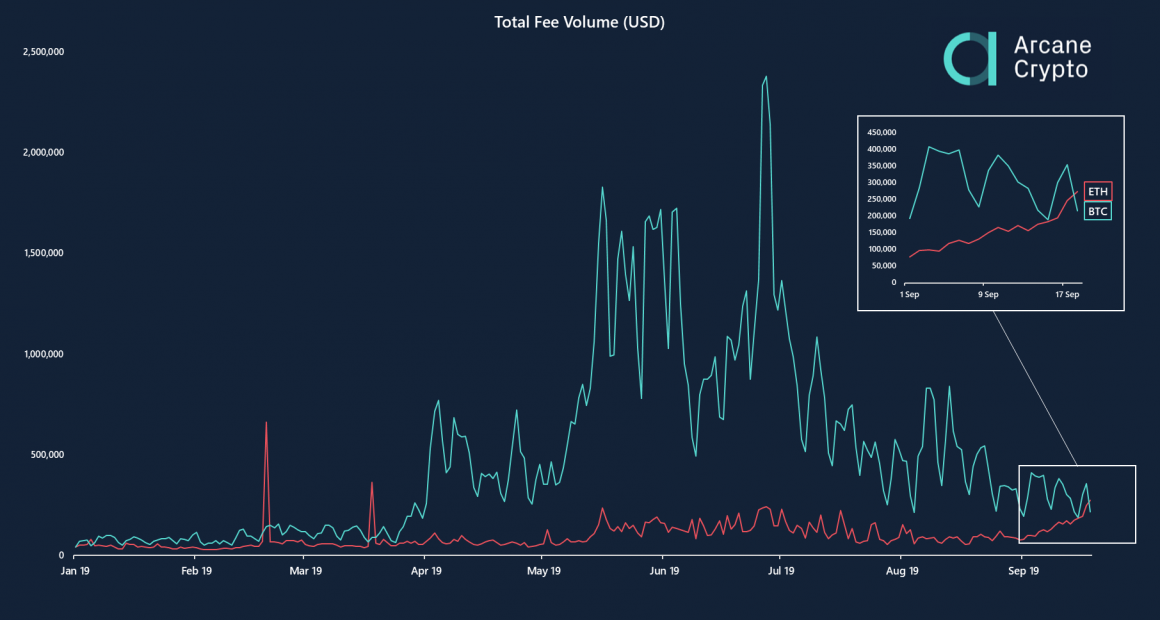

Earlier this week, it was reported that Ethereum transaction fees were about to bypass Bitcoin. This actually happened yesterday, September 18, with daily transaction fees for Ethereum ending at $274,977 and Bitcoin ending at $216,738.

- Read more about altcoins accelerating and falling bitcoin dominance in

“The Weekly Update” by Arcane Research.

This trend has recently appeared , as transaction fees for Bitcoin have fallen, and Ethereum has seen a solid growth.

Blockchain transaction fees are often a good indicator of actual demand and usage.

The use of “gas” at the highest level ever

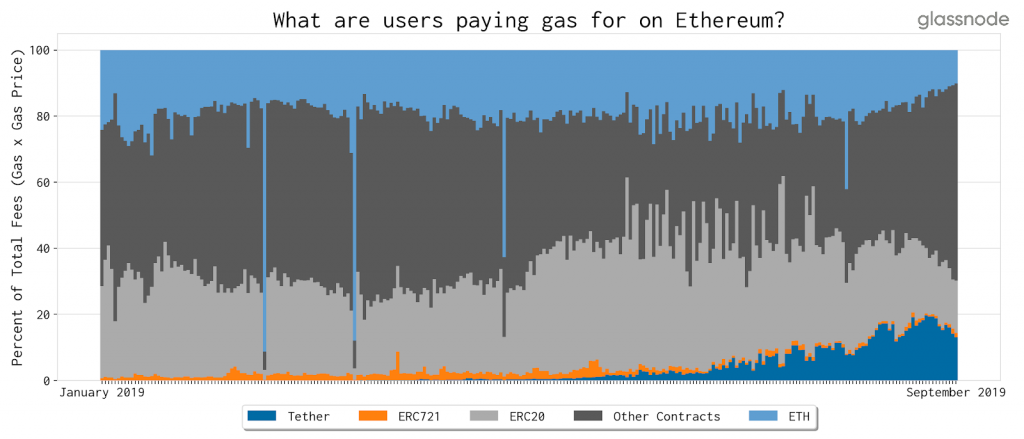

This is further substantiated if we look at the use of “gas” on the Ethereum network, which rose to the highest level ever yesterday. “Gas” is the internal fee for Ethereum blockchain transactions. This means the fee for transactions of both ether (ETH) and other tokens that are on the Ethereum blockchain, such as ERC20-tokens.

Tether an important factor

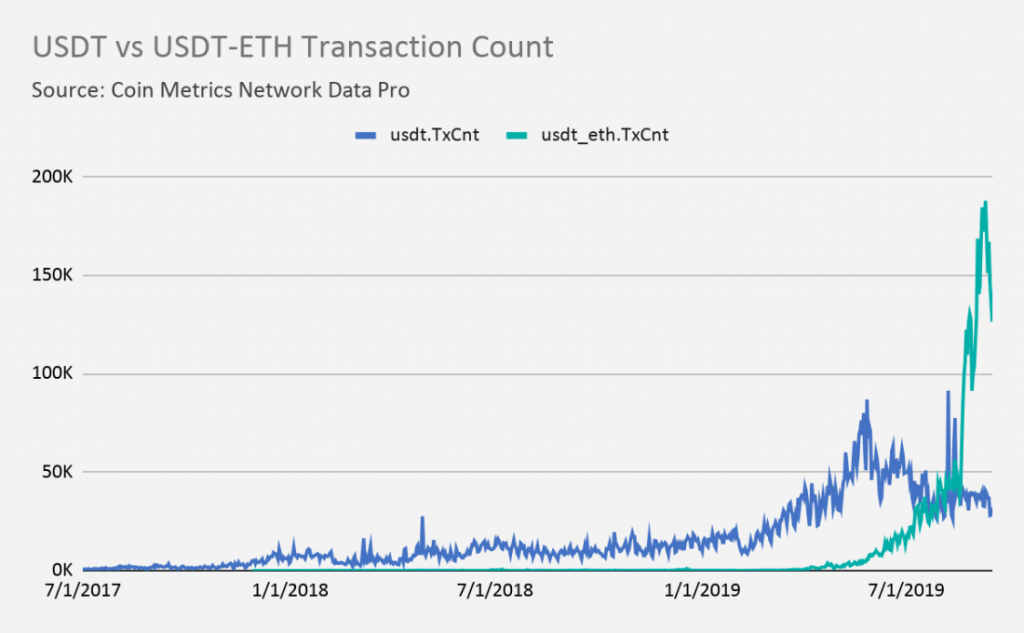

It is namely the stablecoin, Tether, that may be the cause of these changes. Tether (USDT) is now also supported on the Ethereum network. Having previously only been available on the Bitcoin-based protocol OMNI. Tether has also launched a stablecoin linked to the Chinese Yuan (CNHT), which is also on Ethereum’s network.

It is quite clear that users of Tether have moved over to Ethereum. The graph below shows that USDT-ETH has skyrocketed, and has bypassed USDT (Omni) by a good margin. USDT-ETH recently accounted for 25% of all Ethereum transactions on the network.

Decentralized finance is emerging

The narrative that it is only Tether that now drives the price of ETH, may be more intricate. As we see in the graph below, it is actually the “Other Contracts” category that constitutes the largest proportion of network fees on Ethereum and has also grown in the past. These are non-standard smart contracts, which require heavier computations.

This category is often associated with decentralized finance (DeFi), where projects such as MakerDAO and Compound are emerging. For example, we see that the number of dollars locked in DAI has more than doubled since the beginning of August, according to DefiPulse.