It was announced last week via a press release, that Arcane Crypto has signed a letter of intent to acquire the shares in Vertical Ventures, which is listed on Nasdaq First in Stockholm for a 30 million dollar takeover.

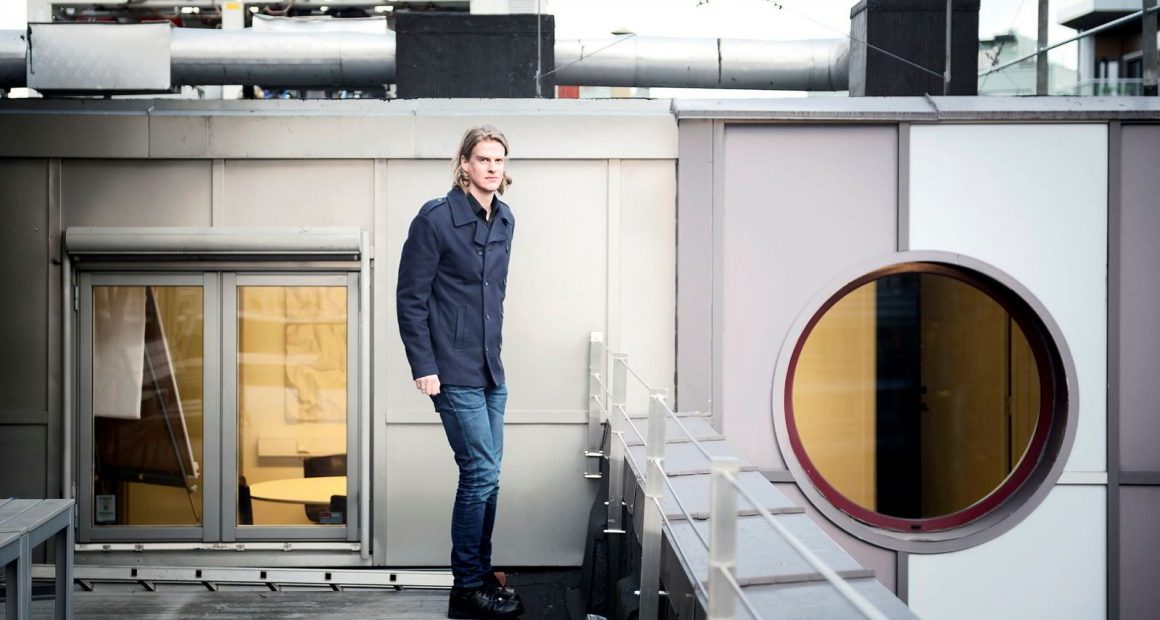

“We see massive potential for Arcane as a listed company. We are growing fast and there are many interesting opportunities on the horizon. By going public we will expand our toolbox and position ourselves for further growth. In addition, our ecosystem approach and infrastructure focus will benefit from the opening up to a wider investor base” says Arcane CEO Torbjørn Bull Jenssen.

Torbjørn is the leading specialist on Bitcoin and blockchain in Norway and a popular public speaker. With an MSc in Economics, he completed his thesis on Bitcoin in 2014. Prior to Arcane, Jenssen worked as a senior economist for Menon Economics.

Two exciting years

Since its inception two years ago, Arcane has spent around 40 million NOK to build the company, and has invested in a number of start-ups and launched a crypto trading hedge fund. This Alphaplate Ltd and Pure Digital Ltd in London, Trijo Exchange in Stockholm.

Total Arcane Crypto consists of six branched, which includes cryptocurrency payment technology, crypto and digital assets, liquidity provision, retail and institutional crypto-fiat exchange as well as research and a hedge fund.

The listing must also be approved by Nasdaq in Stockholm, which Jenssen believes will be will take place in early autumn.

Once the deal with Vertical Ventures AB is complete, Arcane will end up owning 92.5% of the resulting combined company’s shares.

Arcane will be listing in Sweden. This is because the technology environment is much larger in Sweden, but also because the possibility of a vertical acquisition was present.

The listing of Arcane Crypto is a so-called reverse acquisition – a situation where a company gets on the stock exchange without completing a stock exchange itself, which can be time consuming and costly.

This is done by a company acquiring itself and gaining control of a listed company, preferably a listed company that is struggling or no longer has any particular business. Once you have gained control of the listed company, you either complete a merger or acquire the original company.

Jenssen stated that they would have listed the company the normal way, if the opportunity through a reverse acquisition did not exist.