When putting together the pieces of how Bitcoin came to be, it’s meaning, your understanding will start to increase. This phenomenon that already shows signs that are leaving the sphere of personal belief and entering the mass adoption will suffer the same scrutiny that the internet once did.

This is chapter two of a mini-series that will showcase the most important historical events from the conception of Bitcoin till now. This series will be released in parts, this is the second chapter of this story. In this chapter, things are boiling up. People see a commercial gain in Bitcoin. Here we give a prelude, or, set the tone for what will come. We introduce some of the first movers in the bitcoin realm. This here we see the ‘growing pains’ and ‘learning curves’ in Bitcoin history.

Magic Cards and Bitcoin

Jed McCaleb had two passions in life magic fantasy cards and stocks. As a result of these two were his favorite pastimes, he had a lot of spare time made available by an empty social calendar. So in January 2007, he purchased a domain name called mtgox.com, this was short for “Magic: The Gathering Online eXchange.” After he has released the beta version, the game lived for around three months until McCaleb got bored and moved on to another project.

That was until 2010 when McCaleb read about bitcoin on Slashdot. He decided that the bitcoin community needed exchange for trading bitcoins and regular currencies. So on July 18, Mt. Gox launched its exchange and price quoting service deploying it on the spare mtgox.com domain name.

In March 2011, McCaleb sold the site to a french developer with the name of Mark Karpelès. He did this because he wanted to make Mtgox really great it would require more time than he had available…….

In June 2011, there was a security breach of the Mt. Gox bitcoin exchange. It caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt. Gox bitcoin exchange. A hacker had allegedly used credentials from a Mt.Gox auditor compromised computer to transfer a large number of bitcoins illegally to himself. He has used the exchanged software to sell them all nominally, creating a massive ‘ask’ order at any price. Within minutes the price corrected to its correct user-traded value. Accounts with the equivalent of more than 8,7 million were affected. This was the first organized exchange and the first breach of many in the bitcoin market.

This was the first of many catastrophic hacks to come.

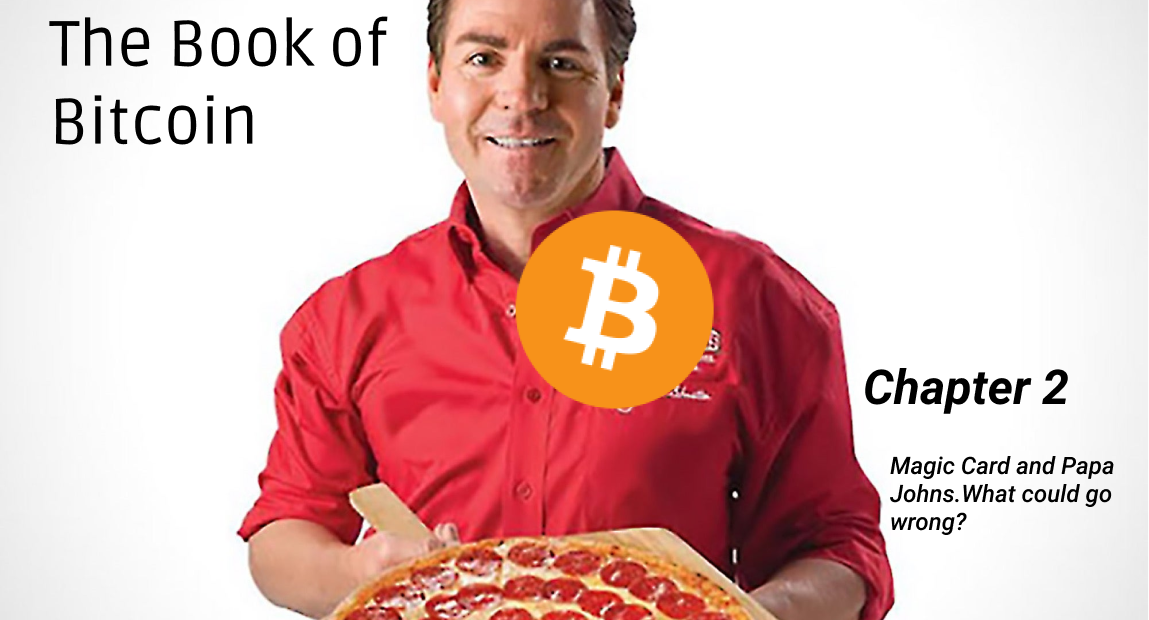

10.000 BTC Pizza

It was late may in Jacksonville, Florida, when a man by the name of Laszlo Hanyecz had an idea. An idea that would later lead to the creation of a universal celebration. He ordered a Pizza. Yes, you read it correctly, the man ordered a pizza and changed the course of history forever.

Laszlo’s had a love for programming, which made him lead him down the pathway to his discovery of Bitcoin.

That is why, on that night in his air-conditioned Florida home, Laszlo decided to test the new currency and community. He enquires in the Bitcointalk forum if anyone would be interested in ordering him a pizza, in exchange for 10,000 Bitcoins. At this time, this amount of Bitcoin was worth $40 dollars. An unknown British man agreed, he transferred the Bitcoin and the man ordered two pizzas from Papa Johns online for around $25 to Laszlo house.

As he opened the door to the Papa John’s delivery man and took those two large all dressed pizzas, at that moment, that transaction took place, history was made.

That day, also known as the 22nd of May 2010, is known for the first recorded purchase of goods made via Bitcoin. At Bitcoins peek, those 10 000 bitcoins were worth close to 800 million USD. Although this amount is only worth 80 million today, this has international recognition and is known as Bitcoin Pizza Day.

Rich Bitcoin Bros

After a little hiccup that turned into a 65 million dollar settlement and an Academy Award-winning movie featuring Arnie Hammer. The Winkelvoss identical brothers were bitter even, a little pissed off. Tyler and Cameron had mastered everything, from prep school, Harvard to rowing the Olympics for the United States (6th place but still an accomplishment). The only thing thing that they hadn’t conquered was the tech world. Zuckerberg had taken that way from them.

They had to find another way in. Their deep anger for Zuckerberg was ingrained, so simple silicon valley startup was not the solution. they had to think bigger than Facebook, bigger than Instagram, BIGGER than Suckerberg (misspelling was tensional).

In 2012, Tyler and his brother Cameron founded Winklevoss Capital Management, a firm invests across multiple asset classes with an emphasis on providing seed funding and infrastructure to early-stage startups.

It was also in 2012, where they bought up 1% of all the bitcoin in circulation at the time for 11 million USD.

Which brings us to 2013. The Winklevoss shined once more, when their company, Math-Based Asset Services LLC filled to register as a Bitcoin-based exchange-traded fund called Winklevoss Bitcoin Trust.

(Bit)Instantly Gone

Charlie was broke. He had just finished university and like all college graduates, you feel inadequate, useless and tired. It tends to be the case because it’s the truth. Charlie was a little different, he had the drive and very good ideas at the right time. He ended up creating a webshop for a department store that wanted to sell rejected goods on the internet. He worked on a commission basis and people become intrigued.

At the same time, he was taking a night course at Brooklyn college to learn about business and was simultaneously diving deeper into the world of bitcoin. He met Gareth Nelson online. They bonded over their frustration mutual frustration of the length of time it took to buy and sell bitcoin on exchange sites. That is how they came up with BitInstant. The concept was a user-friendly company that charged a fee for users to purchase and make purchases with bitcoin providing temporary credit to speed up transactions. BitInstant received a commission for each transaction.

He received a $10,000 loan from his mother. Then he received a $125,000 from Roger Ver. Winklevoss Capital Management soon after sniffed him out and invested 1.5 million. By 2013 BitInstant was processing approximately 30% of all bitcoin transactions.

He got rich quick. Too bad that in March 2013 the US government enacts a regulatory law on bitcoin. This made BitInstant legally a money remitter and requires a license. In July 2013, Charlie shuts down the company.

On January 26th, 2014, Charlies gets arrested at JFK and was charged with money laundering and unlicensed money transfers. This was because he was affiliated with a well-known phenomenon, Silk Road. People were using Bitcoin to purchase things on this site such as drugs, hitmen and occasional sexual favors.

Although for the weak eye these seem like random stories tied together, they are not so random. These innovators, creators, and believers are correlated. They are the fundamental game changers and their introduction needed to be told before we can continue our journey into the Book of Bitcoin.