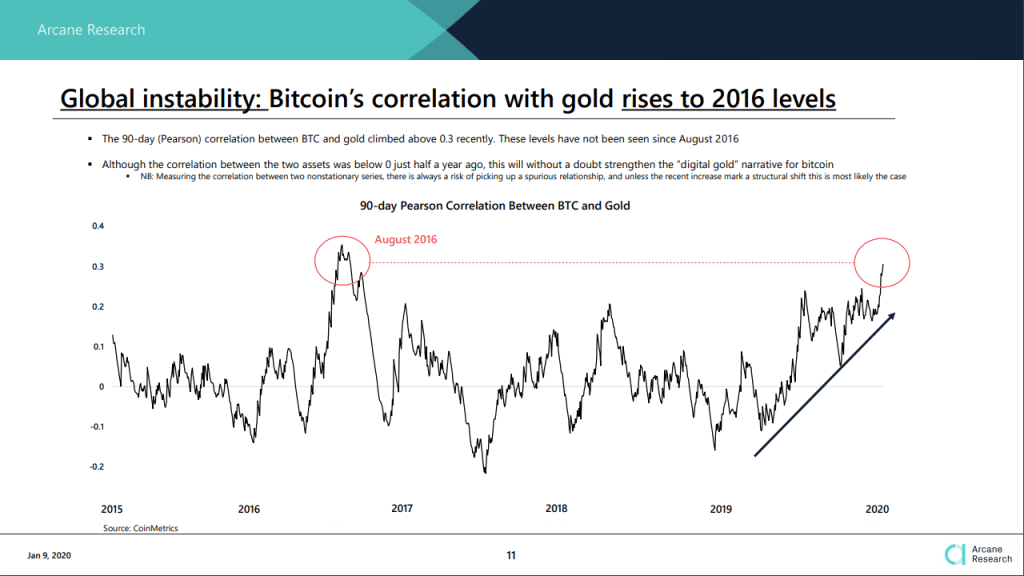

Correlation increases

First and foremost, the correlation between bitcoin and gold is now at the highest levels we have seen in over 3 years. The last time we saw similar levels was in August 2016. Although the correlation between the two assets is only 0.3 (90-day average), this has increased significantly during 2019. Six months ago, the correlation was below 0, but this has changed drastically towards 2020 and especially at the start of the new year.

Read the full weekly report by Arcane Research here.

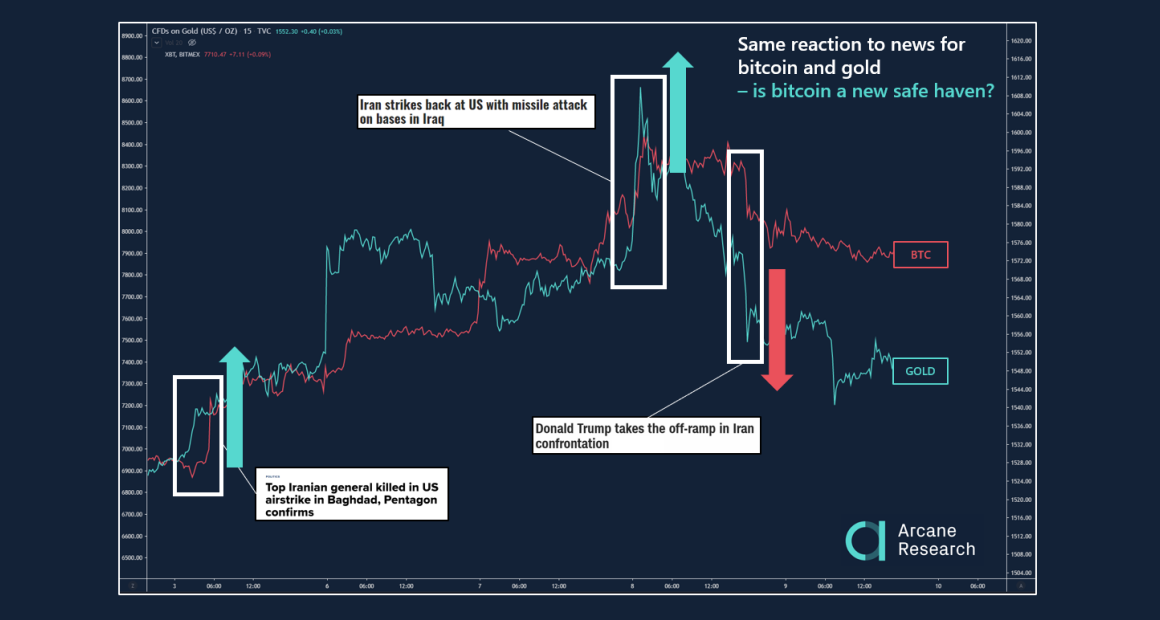

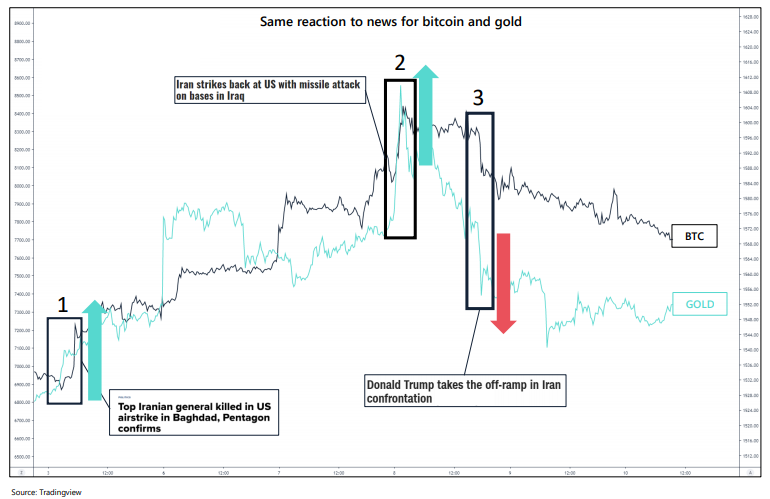

Responds similarly to global news

Arcane Research also highlights how gold and bitcoin prices have moved extensively similar over the past week. The graph below clearly shows how the two assets had the same movements on three occasions.

The first incident is related to the announcement of the killing of Iranian leader Qasem Soleimani. Here, the gold price first jumped up, and bitcoin followed.

The second incident is related to the news that Iran had bombed US military bases in Iraq. Here both the bitcoin price and the gold price jumped up more or less simultaneously.

The third incident came after US President Donald Trump held a press conference that helped to de-escalate the situation with his surprisingly soft rhetoric. Then both asset prices fell suddenly at the same time.

Is bitcoin a new digital gold?

The past week has meant that several are now pointing out that bitcoin is showing signs of being a new digital gold, and can thus act as a safe haven when global turmoil arises. At the same time, it is important not to draw such conclusions prematurely. That said, the correlation between the two assets is barely 0.3, which is closer to 0 (uncorrelated) than 1 (perfectly correlated). Moreover, this correlation can be a result of mere coincidence.

It will be exciting to see how the relationship between the two assets develops in the future. It is not unlikely that the phenomenon of “reflexivity” can occur in the long run. This is linked to the fact that our subjective beliefs can actually affect the economic fundamentals of the assets through a positive feedback loop.

This means that although the price movements we have seen over the past week may have been linked to pure coincidence or an actual relationship between gold and bitcoin, this is something many have noticed. This will reinforce the idea that bitcoin may act as as gold – a hedge against global instability and inflation, which in turn will lead to more people trading bitcoin at global macro events.

Bitcoin’s technical aspects – decentralized, scarce and borderless – make the value object well suited. What is missing, but is becoming more apparent, is a common social unity.

Read the full weekly report by Arcane Research here.

Remember to follow us on Twitter and Facebook.