Powerful rise

In May 2020, the planned halving of “mining rewards” in the Bitcoin chain will come. This means that the number of new bitcoin mined falls from 657,000 per year, to 328,500. According to a hedge fund manager, this could cause the bitcoin price to rise to between $ 20,000 and $ 50,000 as early as next year.

The estimate is given by Charles Hwang, director of the Lightning Capital hedge fund and professor at Baruch College, based on a fundamental analysis of the supply and demand of Bitcoin.

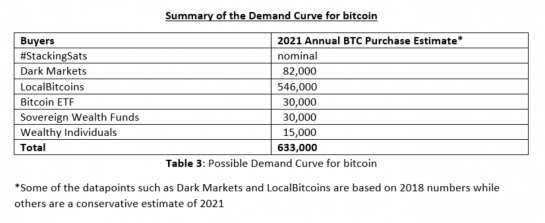

In the now, very well-known medium record of Hwang, he assumes that demand will remain stable at around 633,000 bitcoins through 2021. During the same period, the number of new bitcoins will halve from 657,000 to 328,500.

“This shift in the supply curve is likely to be the starting point for a new and powerful bitcoin rally.”

Although Lightning Capital is only a medium-sized hedge fund, they have good company from other investors, institutions, and analysts who point out that halving mining rewards will send bitcoin higher.

This halving occurs every four years. The previous halves in 2012 and 2016 represented the start of long boom periods, even from different starting points. German bank BayernLB has previously predicted that halving by 2020 will send bitcoin to $ 90,000.

Demand curve

Even Lightning Capital’s Charles Hwang thinks his estimates are conservative. He writes that 82,000 bitcoins will be purchased through dark markets, and 546,000 bitcoins will be purchased through LocalBitcoins.

If there is higher demand from other sources, it could tighten the market even more than Hwang claims. According to the overview, he has set a very low estimate for eg Bitcoin ETF and wealthy individuals. Many view bitcoin as an uncorrelated asset that belongs to a long-term savings portfolio.