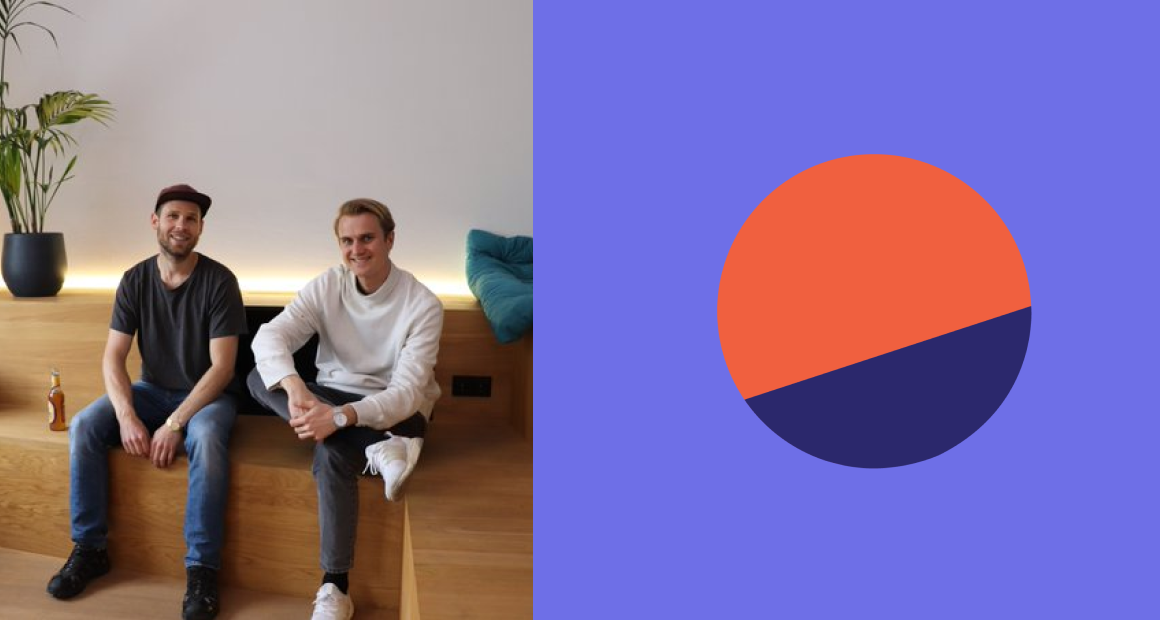

Today, it is easy to check microtransactions on, for example, Etherscan. Yet, if you want to analyze the use of a token or blockchain project, there are few tools available. Fredrik Haga and his business partner, Mats Julian Olsen in Dune Analytics have been busy ahead of the launch of the public version of the analytics program. It is not just because they have had to improve the product, but because they have had paying customers for almost a year already.

“We started the company in September 2018 and got our first paying customer in December of the same year. That was three months after the company was founded.”

Freemium

Today, anyone can go to Dune Analytics and choose a token or smart copy funnel for further analysis. The program is not a purely trading tool but allows you to analyze the activity of all products (dApps) built on Ethereum. If you are not sure how to proceed or what results you are looking for, you can choose to copy others.

“One of our value propositions is to be able to build on each other’s knowledge. With us, you can share analyzes and results, which allows others to learn, but can also copy methods for their own projects. We believe this will strengthen the blocked market as a whole, and create an interesting community on our platform. “

Hold up! Let’s start from the beginning. How did all of this take place?

“First and foremost, it is difficult to extract and process data from a blockchain today. Transactions are available, but the deeper analysis is challenging due to various data sources and manufacturing methods. A blockchain is optimized to verify data, but not for humans should be able to extract information. We have changed this by making it easy to extract and visualize data “

Dune Analytics is targeting crypto companies and in the first round those based on Ethereum. Today, the Ethereum protocol is the next largest with $20 billion worth of blockchains. Yet, it is not all of the individual projects built on Ethereum’s ERC-20 token standard are included, there are several other thousand projects.

“We have primarily sold to start-ups in the blockchain world, but last week we had our first review with the legal department of a larger company. It was educational and gives us a taste of what we have in store as we grow.”

Binance Labs accelerator program

Prior to the summer, both Haga and Olsen were in San Francisco where they participated in Binance Lab’s accelerator program. The focus of the program was pitch training, meeting relevant people in the industry and raising capital.

“Binance Labs has opened many doors for us, and we are very proud to be part of their three-month accelerator program. All companies going through the program quickly understand how doors open when one of the world’s largest blockchain and cryptocurrency players helps you. Binance is a hub for the entire industry. Under the program, they also invested money in Dune Analytics.”

Fredrik defines Dune Analytics as a SaaS (Software as a service) company. They provide software fashion payment. It has been a hot sector, with several IPOs over the past two years.

“For us, the full focus is on getting the free version of the program out into the world, so we get a lot of users. We want to be a reference point in the industry on what’s happening on your blockchain. Soon, we probably want to raise money for growth, as we are only two employees today. “