Demanding process

Over the past year, we have seen that major financial institutions, with several thousand employees and billions of dollars on the balance sheet, have taken their first steps into a new world of decentralized blockchains. Diving into the unknown of trustless transfer between two parties, and regulatory uncertainty.

Those who are familiar with how such processes know, that with larger companies, the decision has to undergo clearance from several departments, from legal, regulatory, financial and technical. The fact that a fund company wants to set up a money market fund on a blockchain so that turnover becomes seamless, has many working hours behind it.

Will create money market funds on the blockchain

Franklin Templeton, that manages to close $700 billion, has now registered a prospect with the Securities and Exchange Commission (SEC) for the tokenization of a money market fund. The fund will invest in bonds, cash, and repo contracts, which are 100% backed by the government. They can also invest in stablecoins, which opens up for digital central bank currencies. They wrote in their official press release:

“We believe that blockchain technologies have the ability to knit traditional asset management products and services closer to transactional payments and a registered money market fund with its shares existing as native digital assets on a blockchain and held in a digital wallet, can be an ideal stable digital asset to be used in the new economy. “

Several other players are taking the step

Templeton is not alone in seeing the value of blockchains. HSBC, the world’s seventh-largest bank with $ 2.55 trillion on its balance sheet, earlier this week made its first transaction with a blockchain-based “letter of credit”, denominated in Chinese Yuan. The transaction itself took place on the Voltron platform, which has been developed by eight major banks, including BNP Paribas and Standard Chartered.

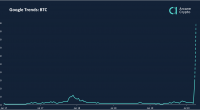

The SEC has postponed the decision on listing a Bitcoin ETF for nearly two years, but have now accepted an application that allows VanEck and SolidX to sell a “limited version” of a Bitcoin ETF to institutional customers. This means that the market now knows what the appetite really is with the big funds. Meanwhile, the authorities are testing the waters on whether Bitcoin ETFs intended for the general public can later be approved.

In Norway, Sparebanken Øst announced that they take a 16.3% stake in the Norwegian Block Exchange. This is the first time a European bank has invested in a crypto exchange and shows that bank management is now seeing that cryptocurrency and future DeFi products are attractive assets that they should now act on.